Johor's Property Market Is Heating Up: What the JS-SEZ and RTS Link Mean for Homebuyers and Investors

timer

6 minutes read

September 9, 2025

Johor is undergoing a once-in-a-generation transformation.

Johor is undergoing a once-in-a-generation transformation with the launch of two pivotal projects: the Johor–Singapore Special Economic Zone (JS-SEZ) and the Rapid Transit System (RTS) Link.

The JS-SEZ, launched officially on January 8, 2025, covers a massive 3,288 km² across nine zones of Johor — nearly five times the size of Singapore. It integrates economic zones including Iskandar Malaysia and Pengerang, and aims to attract investments in 11 priority sectors such as logistics, manufacturing, digital economy, and health [[JLL Malaysia]].

The RTS Link is a 4-km cross-border rail from Bukit Chagar (Johor Bahru) to Woodlands (Singapore), expected to begin operations in late 2026. It will cut travel time to just six minutes and can carry up to 10,000 passengers per hour in each direction, easing the daily commute and boosting connectivity [[JLL via The Edge]].

👉 For property buyers and investors, this means rising demand and climbing prices—already visible in 2025 data.

Malaysians working in Singapore – Over 300,000 commute daily, and the RTS will make Johor living even more convenient ([Straits Times]).

Singaporean buyers – Facing SGD $1M+ prices for small flats at home, they view Johor as a value play. Standard Chartered called Johor property a “structural pivot point” for Singapore investors ([Standard Chartered Research]).

Local Malaysians – First-time buyers benefit from new tax reliefs and stamp duty exemptions in Budget 2025 ([MOF Malaysia]).

“Residential property demand in Johor is led by locals, Malaysians working in Singapore, and Singaporeans, with the JS-SEZ poised to attract greater foreign interest.” — Bernama

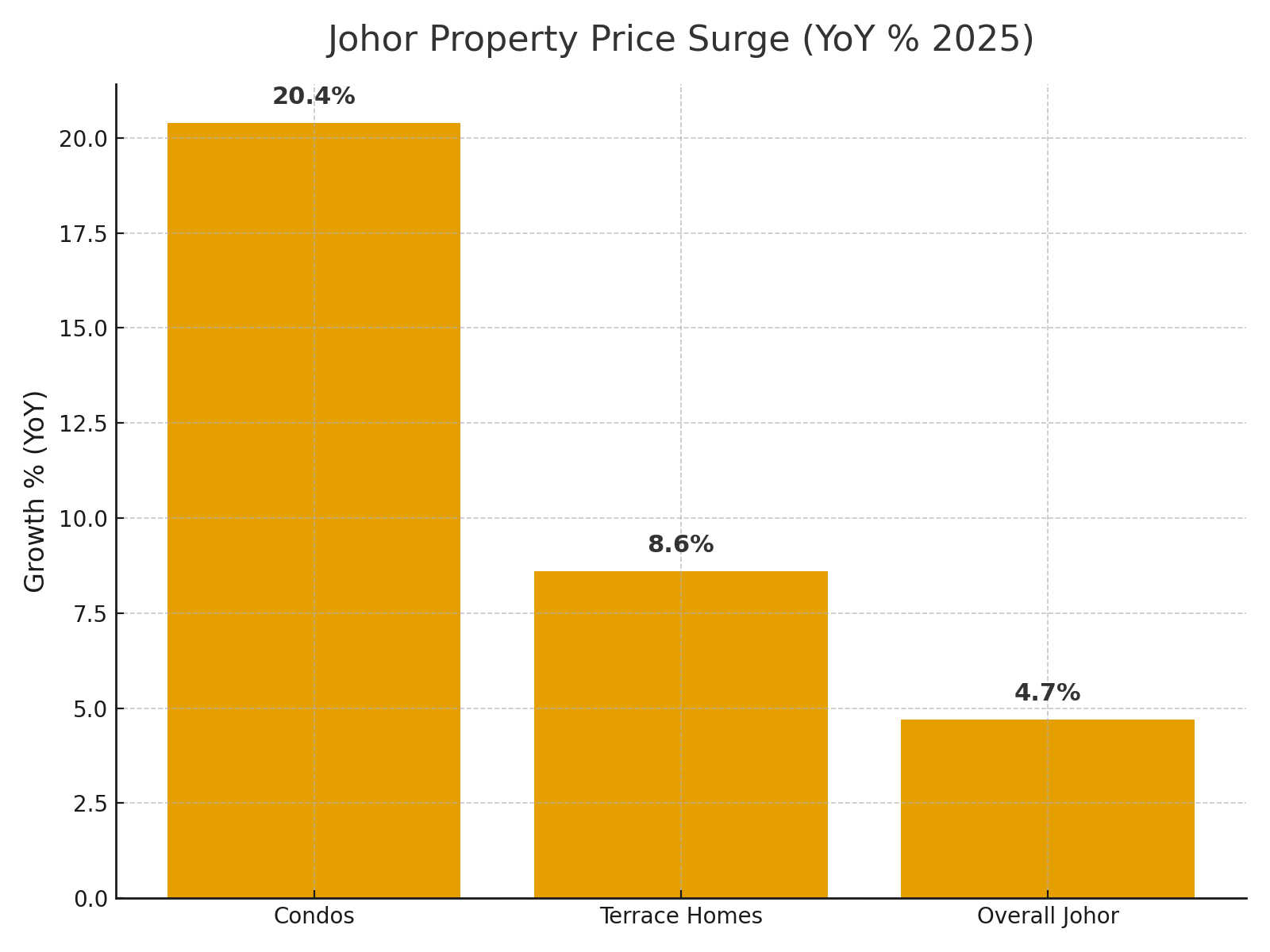

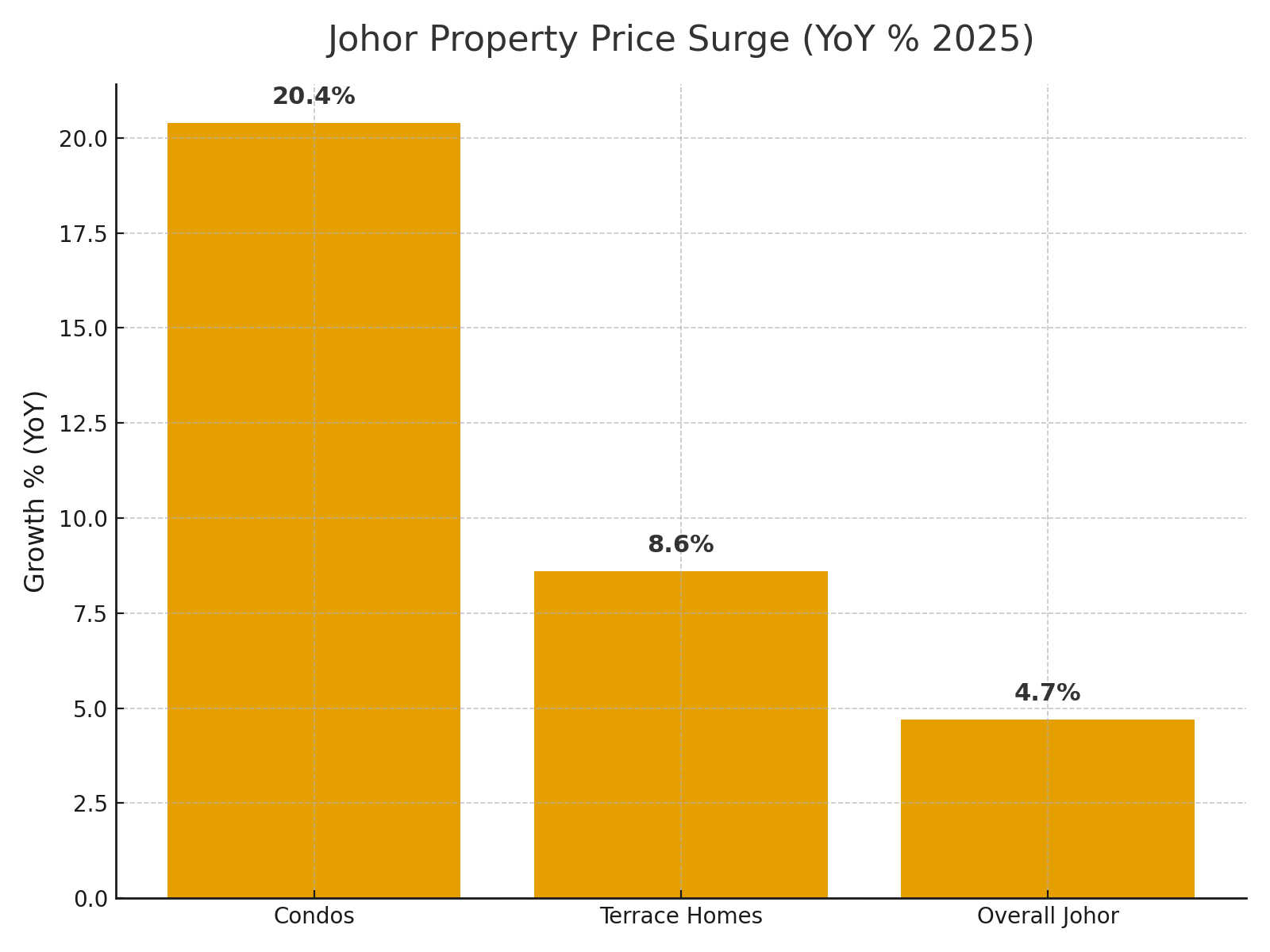

+20.4% YoY in Johor Bahru serviced apartment prices (Q2 2025) ([The Edge])

+8.6% YoY in double-storey terrace houses (Q2 2025) ([The Edge])

Land near RTS: jumped from RM600–900/ft² to RM2,000+/ft² in recent transactions ([Standard Chartered])

Johor overall: +4.7% in average residential prices and +6.5% in transactions in 1H 2025 ([NAPIC Malaysia])

High-Rises: Surging in demand near RTS and transit hubs, with strong rental potential. JLL notes “growing strength in rental markets near RTS” ([JLL via The Edge]).

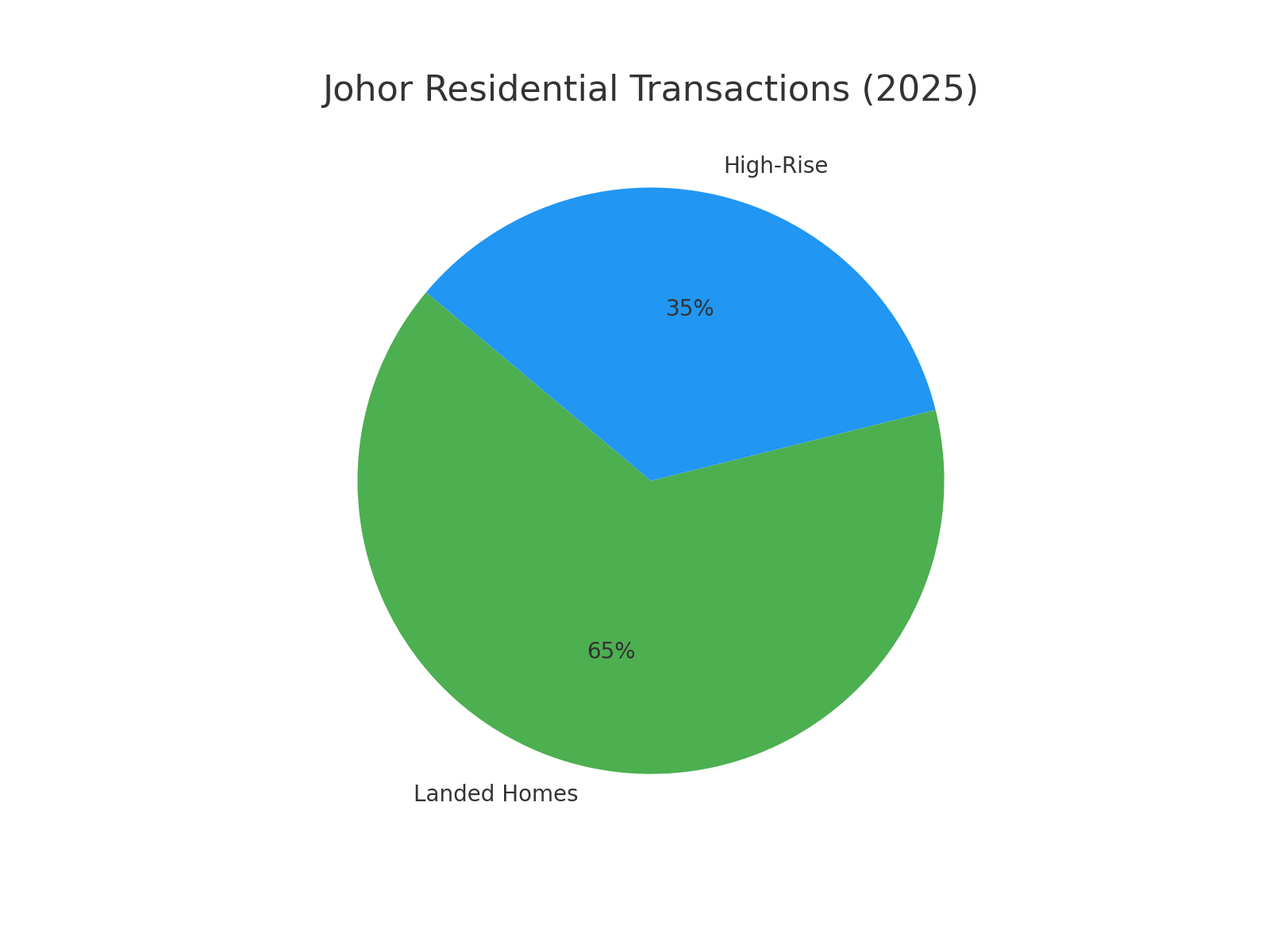

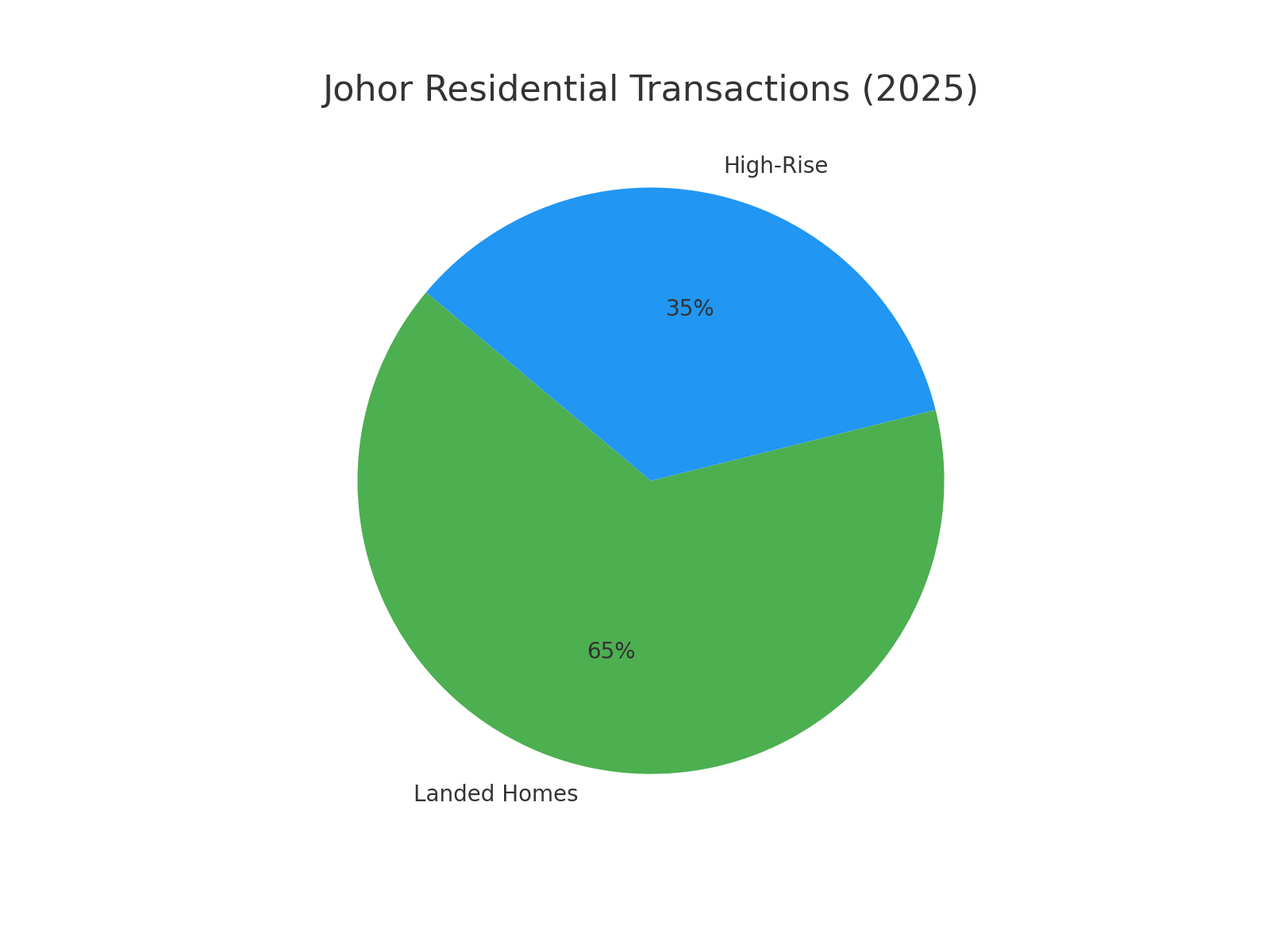

👉 Takeaway: Landed homes remain king, but condos near RTS stations are the hottest growth segment.

First-time buyer relief: Up to RM7,000 tax relief on loan interest for homes ≤RM500k ([Bernama]).

Stamp duty exemption: Extended for homes ≤RM1M, helping clear unsold inventory ([Henry Butcher Malaysia]).

SEZ tax perks: 5% corporate tax for firms, 15% income tax for knowledge workers ([MIDA]).

Price Growth: Expect continued 5–10% annual appreciation in areas near RTS/SEZ hubs ([JLL]).

Rental Market: Strong demand from Singapore commuters and foreign professionals.

GDP Impact: Johor’s GDP could hit RM250 billion by 2030 under SEZ growth ([ANZ Research]).

“The RTS Link, scheduled for completion by end-2026, is expected to enhance cross-border connectivity and further strengthen Johor Bahru’s position as a residential hub.” — [Bernama]

For homebuyers, this means more choice but rising prices. For investors, it’s a rare chance to get in before the RTS opens in 2026.

👉 The smart move now: focus on properties within RTS catchment areas and SEZ flagship zones.

1) What is the JS-SEZ and why does it matter to Johor homebuyers?

It’s the Johor–Singapore Special Economic Zone launched in 2025 to attract high-value industries and talent, which supports jobs, incomes, and housing demand near key hubs.

2) When will the RTS Link open and how long is the ride?

Targeted for end-2026; the cross-border ride Bukit Chagar ↔ Woodlands is about six minutes.

3) Are Johor home prices rising?

Yes. 2025 data show notable YoY gains—especially near RTS/prime JB areas—driven by cross-border demand.

4) Which areas may benefit most from the RTS?

Transit-adjacent zones: Bukit Chagar/JB City, Iskandar Puteri, and connected corridors typically see stronger buyer and rental interest.

5) Are landed homes or condos performing better?

Landed homes still dominate transactions, but condos near transit and job nodes show faster demand growth and rental traction.

6) Can Singaporeans buy property in Johor?

Yes, subject to state rules (minimum price thresholds and approvals). Fees and policies can differ by state; check Johor’s current guidelines.

7) What incentives help first-time Malaysian buyers?

Budget measures include loan-interest tax relief and stamp-duty exemptions within set price caps (subject to yearly budgets and eligibility).

8) What’s the outlook to 2026 and beyond?

With JS-SEZ scaling and RTS completion, analysts expect continued demand, firmer prices in RTS catchments, and a stronger rental market.

9) What risks should buyers consider?

Project supply timing, interest-rate moves, and policy changes. Always review developer track record and transit timelines.

10) How can investors position now?

Prioritize transit-oriented, high-demand micro-locations with strong tenant pools (cross-border workers, professionals), and balanced maintenance fees.

Johor is undergoing a once-in-a-generation transformation with the launch of two pivotal projects: the Johor–Singapore Special Economic Zone (JS-SEZ) and the Rapid Transit System (RTS) Link.

The JS-SEZ, launched officially on January 8, 2025, covers a massive 3,288 km² across nine zones of Johor — nearly five times the size of Singapore. It integrates economic zones including Iskandar Malaysia and Pengerang, and aims to attract investments in 11 priority sectors such as logistics, manufacturing, digital economy, and health [[JLL Malaysia]].

The RTS Link is a 4-km cross-border rail from Bukit Chagar (Johor Bahru) to Woodlands (Singapore), expected to begin operations in late 2026. It will cut travel time to just six minutes and can carry up to 10,000 passengers per hour in each direction, easing the daily commute and boosting connectivity [[JLL via The Edge]].

👉 For property buyers and investors, this means rising demand and climbing prices—already visible in 2025 data.

🏠 Who’s Driving the Demand?

Three buyer groups are reshaping Johor’s residential market:Malaysians working in Singapore – Over 300,000 commute daily, and the RTS will make Johor living even more convenient ([Straits Times]).

Singaporean buyers – Facing SGD $1M+ prices for small flats at home, they view Johor as a value play. Standard Chartered called Johor property a “structural pivot point” for Singapore investors ([Standard Chartered Research]).

Local Malaysians – First-time buyers benefit from new tax reliefs and stamp duty exemptions in Budget 2025 ([MOF Malaysia]).

“Residential property demand in Johor is led by locals, Malaysians working in Singapore, and Singaporeans, with the JS-SEZ poised to attract greater foreign interest.” — Bernama

📈 Prices Are Already Rising

The numbers tell the story:+20.4% YoY in Johor Bahru serviced apartment prices (Q2 2025) ([The Edge])

+8.6% YoY in double-storey terrace houses (Q2 2025) ([The Edge])

Land near RTS: jumped from RM600–900/ft² to RM2,000+/ft² in recent transactions ([Standard Chartered])

Johor overall: +4.7% in average residential prices and +6.5% in transactions in 1H 2025 ([NAPIC Malaysia])

🏡 Landed vs High-Rise: A Market in Transition

Landed Homes: Still dominate with 65% of transactions ([Bernama]), popular among local families.High-Rises: Surging in demand near RTS and transit hubs, with strong rental potential. JLL notes “growing strength in rental markets near RTS” ([JLL via The Edge]).

👉 Takeaway: Landed homes remain king, but condos near RTS stations are the hottest growth segment.

💡 Policies & Incentives That Matter

Foreign buyer fee hike: Approval fees in Johor rose from 2% → 3% (min RM30k) as of July 2025 ([The Star]).First-time buyer relief: Up to RM7,000 tax relief on loan interest for homes ≤RM500k ([Bernama]).

Stamp duty exemption: Extended for homes ≤RM1M, helping clear unsold inventory ([Henry Butcher Malaysia]).

SEZ tax perks: 5% corporate tax for firms, 15% income tax for knowledge workers ([MIDA]).

🔮 Forecast: 2026 and Beyond

Analysts see Johor as Southeast Asia’s next twin-city hub:Price Growth: Expect continued 5–10% annual appreciation in areas near RTS/SEZ hubs ([JLL]).

Rental Market: Strong demand from Singapore commuters and foreign professionals.

GDP Impact: Johor’s GDP could hit RM250 billion by 2030 under SEZ growth ([ANZ Research]).

“The RTS Link, scheduled for completion by end-2026, is expected to enhance cross-border connectivity and further strengthen Johor Bahru’s position as a residential hub.” — [Bernama]

✅ Final Word

The Johor property market is at an inflection point. The JS-SEZ and RTS Link are not short-term catalysts—they’re long-term growth drivers that will transform Johor into Singapore’s affordable twin city.For homebuyers, this means more choice but rising prices. For investors, it’s a rare chance to get in before the RTS opens in 2026.

👉 The smart move now: focus on properties within RTS catchment areas and SEZ flagship zones.

FAQ

1) What is the JS-SEZ and why does it matter to Johor homebuyers?

It’s the Johor–Singapore Special Economic Zone launched in 2025 to attract high-value industries and talent, which supports jobs, incomes, and housing demand near key hubs.

2) When will the RTS Link open and how long is the ride?

Targeted for end-2026; the cross-border ride Bukit Chagar ↔ Woodlands is about six minutes.

3) Are Johor home prices rising?

Yes. 2025 data show notable YoY gains—especially near RTS/prime JB areas—driven by cross-border demand.

4) Which areas may benefit most from the RTS?

Transit-adjacent zones: Bukit Chagar/JB City, Iskandar Puteri, and connected corridors typically see stronger buyer and rental interest.

5) Are landed homes or condos performing better?

Landed homes still dominate transactions, but condos near transit and job nodes show faster demand growth and rental traction.

6) Can Singaporeans buy property in Johor?

Yes, subject to state rules (minimum price thresholds and approvals). Fees and policies can differ by state; check Johor’s current guidelines.

7) What incentives help first-time Malaysian buyers?

Budget measures include loan-interest tax relief and stamp-duty exemptions within set price caps (subject to yearly budgets and eligibility).

8) What’s the outlook to 2026 and beyond?

With JS-SEZ scaling and RTS completion, analysts expect continued demand, firmer prices in RTS catchments, and a stronger rental market.

9) What risks should buyers consider?

Project supply timing, interest-rate moves, and policy changes. Always review developer track record and transit timelines.

10) How can investors position now?

Prioritize transit-oriented, high-demand micro-locations with strong tenant pools (cross-border workers, professionals), and balanced maintenance fees.

Copyright © 2026 MyRumahBaru

Copyright © 2026 MyRumahBaru